The National Bank of Canada agreed to buy Canadian Western Bank for about C$5 billion (US$3.6 billion) in stock, forming a coalition with two of the country’s regional lenders.

The acquirer will pay the equivalent of $52.24 per share for Canadian Western, more than 110 per cent more than the target’s closing price on Tuesday, according to a statement. The purchase requires the approval of the Canadian government and two-thirds of CWB’s shareholders, who are set to vote on the proposal at a special meeting in September. The deal is expected to close by the end of next year.

For the National Bank, Canada’s sixth-largest lender with $442 billion in assets, the agreement represents an opportunity to diversify its income from Quebec, where it is one of the most prominent financial firms. Its stability has made it one of Canada’s top-performing banks, with its stock up 21 per cent over the past year as of Tuesday’s close.

Now it’s using that equity to acquire a weaker rival.

The big five lenders in Toronto and Montreal-based National Bank dominate the sector in Canada. And while bank merger opportunities are rare in the country, the deal comes just months after Royal Bank of Canada completed its $13.5 billion deal for HSBC Holdings Plc’s Canadian assets after overcoming regulatory scrutiny. Smaller player Laurentian Bank of Canada was unable to find a buyer after conducting a strategic review last year. National Bank already has “roots and a long presence” in Western Canada, which is a “priority growth market” for the company, Chief Executive Officer Laurent Ferreira said on a conference call after the deal was announced. “We have a strong team in the financial-markets space, including commercial bankers, private bankers and wealth advisers, as well as global markets and corporate and investment banking.” The deal would give National Bank a bigger retail footprint in the western provinces of Alberta and British Columbia, home to Canadian Western’s 39 branches, 65,000 customers and $37 billion in loans. Edmonton, Alberta-based CWB has also worked to diversify from its home province, which has been plagued by the boom-and-bust cycles of the oil business. The firm opened its first branch in Ontario in 2020, launched a banking centre in Toronto earlier this year and has also expanded into other areas including equipment-leasing and wealth management.

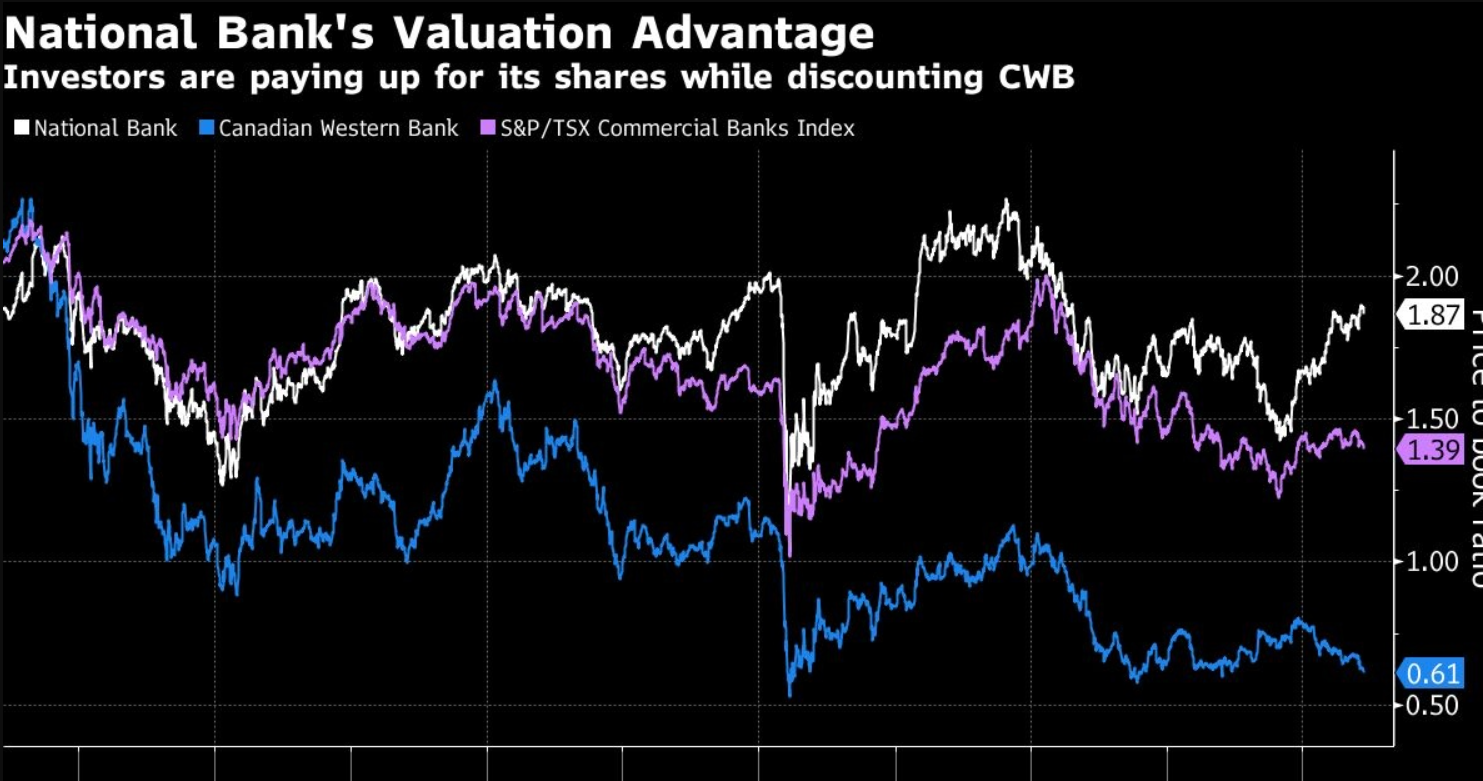

But CWB shares have languished, trading at less than 70 per cent of book value before the bid. Rising loan losses are a concern — the main reason the bank missed analysts’ expectations for earnings in the fiscal second quarter — and it has struggled with slow loan growth.

‘High premium’

According to Bloomberg Intelligence analysts Paul Gulberg and Ethan Kaye, the deal is “expensive” but in line with RBC’s recent acquisition of HSBC’s Canadian assets.

“The high premium and the three-year path to EPS accretion following the expected closing in late 2025 are quite long,” they wrote in a research note. National’s shares fell 5.3 per cent to $110.15 as of 9:51 a.m. in Toronto on Wednesday. Canadian Western’s shares rose 72 per cent to $42.81.

National Bank said it has identified annual pretax cost and funding synergies of $270 million that it expects to achieve three years after completing the deal, while estimating it will spend about $400 million on pretax integration costs over two years.

The lender already owns about six per cent of Canadian Western stock and the total value of the transaction excluding those shares is about $4.7 billion. The deal will see 0.45 of a National Bank common share exchanged for each Canadian Western share.

National Bank plans to issue $1 billion of new equity, and Quebec’s largest pension fund, Caisse de depôt et placement du Québec, said it will help finance the deal by investing $500 million in National Bank through subscription receipts, a move that will make it the lender’s second-largest shareholder.

“CDPQ is proud to continue its long-term commitment to National Bank by participating in this transformational acquisition, which will enable it to execute a new aspect of its expansion plan,” Vincent Delisle, the fund’s head of liquid markets, said in a statement. The other $500 million will come through a public offering of subscription receipts, which is being underwritten on a bought-deal basis, and both offerings are expected to take place on or around June 17.